Financial trauma refers to the emotional, cognitive, relational, and physical symptoms triggered by significant financial stressors. These stressors can include poverty, homelessness, food insecurity, and unemployment, which can have a lasting impact on one’s mental, physical, and financial health. Financial trauma is extremely common and effective treatment and resources are available to help.

Take a look at this video and see if you recognize the signs of financial trauma:

Recover from financial trauma with the help of a therapist Therapy can help you overcome financial trauma. BetterHelp provides convenient and affordable online therapy, starting at $65 per week. Take a Free Online Assessment and get matched with the right therapist for you!

What Is Financial Trauma?

Financial trauma, also known as money trauma or financial PTSD, is not an official psychiatric diagnosis, but is often used to describe financially triggered PTSD. This includes different challenges people experience when they have difficulty coping with either an abrupt financial loss or the chronic stress of having inadequate financial resources.

The symptoms of money trauma parallel the symptoms of PTSD. Physical symptoms include nervousness, jitters, and insomnia, among others. Emotionally, one might not be able to feel close to others as they experience apathy, anxiety, depression, hopelessness, or despair due to their circumstances. Meanwhile, persistent negative thoughts about finances may make it difficult to concentrate. These symptoms disrupt the home and/or work life and cause significant distress. According to research, 23 percent of adults and 36 percent of millennials experience financial stress at levels that qualify for a diagnosis of PTSD.1

Possible symptoms of financial trauma include:

- Hypervigilance: This is a sensitive sensory state marked by exaggerated behavior to detect a threat. Hypervigilance might look like agitation or being on edge whenever the topic of finances comes up.2

- Avoidance behaviors: Avoidance behaviors may include avoiding opening bills and financial statements, not logging in to credit card or banking accounts, declining a social invitation to limit spending, and so forth.

- Startle response: This occurs when the body has a strong panic response to triggers such as the phone ringing (thinking it could be bill collectors).

- Sleep disturbance: Financial trauma can result in difficulty falling asleep, staying asleep, or insomnia due to financial stress.

- Self-destructive behavior: This may include overspending, self-harm like cutting, or quitting a job out of frustration.

- Money anxiety: Money anxiety is excessive worry, nervousness, and fear about finances.

- Appetite disturbances: A person may experience a lack of appetite or overeat in response to money anxiety.

- Somatic complaints: Physical symptoms may include muscle tension, tightness in the jaw, gastrointestinal problems, headaches, migraines, and other pains.

- Rumination: Rumination refers to excessive second guessing about past decisions, choices, or actions.

- Obsessive-compulsive behaviors: A person may obsess about finances (balances or upcoming bills) and engage in checking behaviors to ease this (financial accounts, financial news, stocks, etc.).3

- Analysis paralysis: One may feel frozen when it comes to making even simple financial decisions (such as grocery purchases).

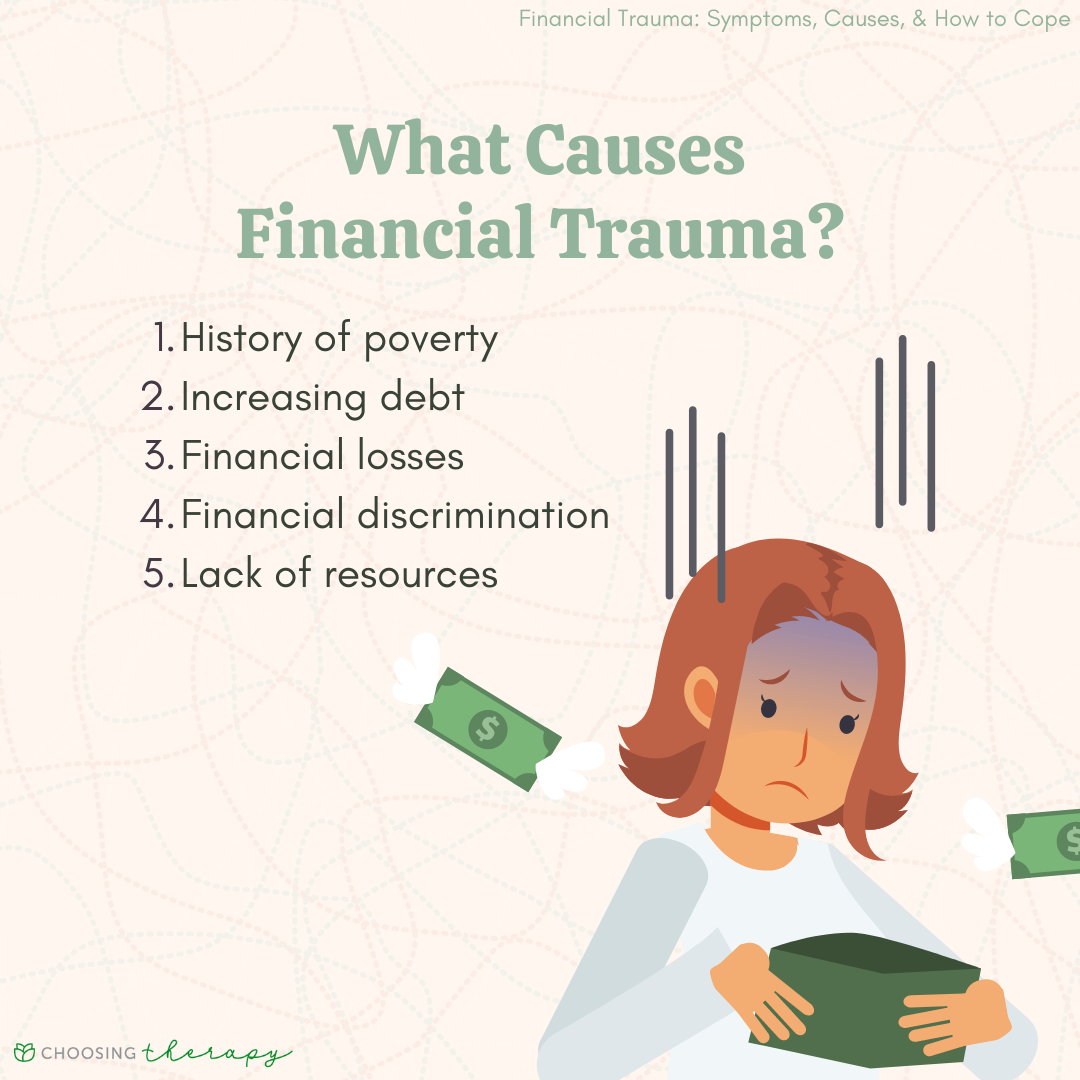

What Causes Financial Trauma?

Financial traumas can be caused by large-scale events, such as a global pandemic or economic recession, or smaller occurrences such as unemployment or healthcare costs. It can also be passed down by generations within family systems. Not only can it be influenced by direct financial hardships, but also by racism, marginalization, internalized belief systems, and sexism.

Possible causes of financial trauma include:

History of Poverty

The impact of poverty on mental health is paramount, and can trigger anxiety, depression, substance use disorders, eating disorders, and trauma. Traumas are events that our minds and bodies can’t process like usual life experiences. The result is emotional, cognitive, and physical symptoms that can make it difficult to function.

Although it may be painful to explore, it’s important to reflect on how you may have been impacted by intergenerational trauma like slavery, the Holocaust, genocide, or major economic crises. It’s also crucial to understand the impact of the chronic stress of poverty, inadequate financial resources, and traumatic financial losses.

According to research, trauma within a family system alters how DNA is expressed in an individual, thus allowing it to pass into future generations. Essentially, individuals inherit the “emotional DNA” of family members which can include the shared feelings towards money and finances.4

Increasing Debt

Substantial debt can lead to money anxiety about student loans, car payments, mortgages, business loans, and credit cards. If your partner or spouse has a lot of debt or you are in a financially dependent relationship with them, it can trigger financial trauma in you. For some, accruing debt is an addictive and compulsive behavior.

Financial Losses

Financial trauma can be triggered by loss of income due to a variety of situations and circumstances.

Income loss that may lead to money trauma include:

- Job loss, unemployment

- A failing business

- A breakup or divorce

- Benefits running out

- End of alimony or child support

- End of assistance or disability coverage

- Death of a family member

Financial Discrimination

Financial discrimination may be based on race, culture, religion, gender, or sexual identity. BIPOC, members of the LGBTQIA+ population, women, older adults, and members of non-dominant cultural or religious groups experience marginalization that impairs ability to obtain work, as well as opportunities for upward mobility.

Lack of Resources

A lack of resources can greatly contribute to financial trauma. For example, food is a basic necessity and not having adequate food can be terrifying, especially for parents who need to not only feed themselves but also their children. Furthermore, a lack of access to money, health insurance, or government assistance such as food stamps or Medicaid/Medicare can trigger financial trauma.

Help For Trauma / PTSD Talk Therapy – Get help recovering from trauma from a licensed therapist. Betterhelp offers online therapy starting at $60 per week. Free Assessment Online PTSD treatment – Talkiatry offers personalized care from psychiatrists who listen and take insurance. Get matched with a specialist in just 15 minutes. Take our assessment

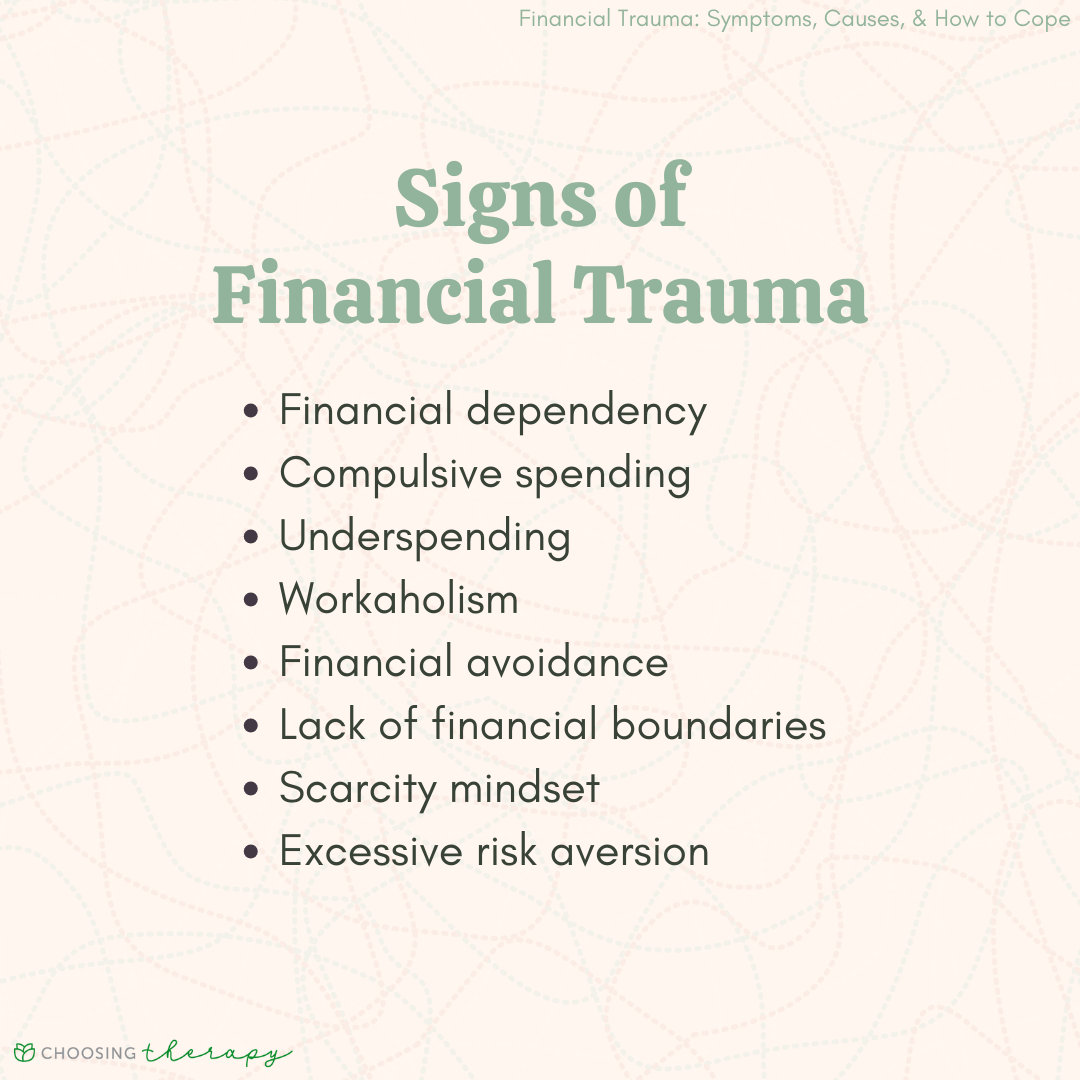

Signs of Financial Trauma

There are various signs of financial trauma a person can look out for in themselves or others. This condition often impacts a person’s spending habits, financial relationships with others, and mental wellbeing.

Possible signs of financial trauma include:

Financial Dependency

Financial dependency occurs when a person relies on another person for meeting their financial needs. Examples include children and their parents, the elderly with their caregivers, and stay-at-home partners. Victims of financial trauma may be more susceptible to becoming financially dependent and victims of financial abuse when they experience chronic financial stress.

Compulsive Spending

People with financial trauma may engage in compulsive shopping or overspending, which may even lead to a shopping addiction. As humans, we often unconsciously recreate patterns until we become aware of and choose to change them. So, your past money story may be constraining your current financial success in the form of financial self-sabotage through over-spending.

Underspending

Financial disorders are similar to eating disorders in that there are obsessions and compulsions with themes of power and control. When people feel out of control due to money trauma, they may become miserly or extremely frugal in an effort to calm their money anxiety. These restrictive behaviors can be harmful, especially if the person is not paying for nutritious food or healthcare that is needed for their overall wellness.

Workaholism

Workaholism is often a response to financial trauma as a person may work excessively to avoid future financial difficulty or traumas. This can lead to overwork and burnout, which has serious mental and physical health complications.

Financial Avoidance

Financial avoidance can involve behaviors such as refusing to talk about finances with other people, financial denial about debt and net worth, and refusing to open bills or look at bank statements. Victims of financial trauma may be financially avoidant because dealing with money triggers feelings of fear, overwhelm, and worry, so they would rather stick their heads in the sand.

Lack of Financial Boundaries

When people have been victims of financial trauma, such as financial abuse in a marriage, they may have difficulty setting healthy financial limits and boundaries in their relationships at home and work. This can lead to some codependent behaviors or causing financial harm to oneself.

Scarcity Mindset

A scarcity mindset is rooted in the idea that there are not enough resources (food, jobs, money) for all of us, so we need to be fearful and competitive with others. While this is a normal response to money trauma, it can cause financial harm. Scarcity thinking can also lead people to keep and hoard objects they perceive as scarce, sometimes resulting in an anxiety disorder or a hoarding disorder.

Excessive Risk Aversion

It takes money to make money and when somebody has been financially traumatized, they may be overly cautious about taking necessary financial risks. This may include student loans to better their education, getting a business loan to grow their company, or even putting money in the bank due to feelings of mistrust. All of this can impair financial health and be costly over time.

Recover from financial trauma with the help of a therapist Therapy can help you overcome financial trauma. BetterHelp provides convenient and affordable online therapy, starting at $65 per week. Take a Free Online Assessment and get matched with the right therapist for you!

Impacts of Financial Trauma

Money trauma impacts a person both mentally and physically and can also impair one’s relationships or productivity and functioning at work.

Possible impacts of financial trauma include:

- Family dysfunction: Money trauma can increase the likelihood of family dysfunction as family members face conflict stemming from financial problems or anxiety over money. This can cause interpersonal conflict, destroy marriages, and negatively affect children.

- Substance misuse: A person may begin to use substances when dealing with financial trauma. If these behaviors exacerbate they can turn into a substance use disorder or addiction.

- Gambling: Money trauma is associated with gambling perhaps because people are looking for a quick fix out of desperation. These behaviors can lead into a serious gambling addiction.

- Mental health conditions: Money trauma can lead to ongoing mental health conditions including low self-esteem, generalized anxiety disorder, panic disorder, depression, and suicidal thoughts.5, 6, 7, 8

- Physical health conditions: Long-term stress releases hormones that can wear down the mind and body, causing diabetes, heart disease, high blood pressure, and other health concerns.9

- Work impairment: Studies show money trauma can cause cognitive and health symptoms that impair ability to function well at work, reducing productivity and increasing the likelihood of errors or accidents.10

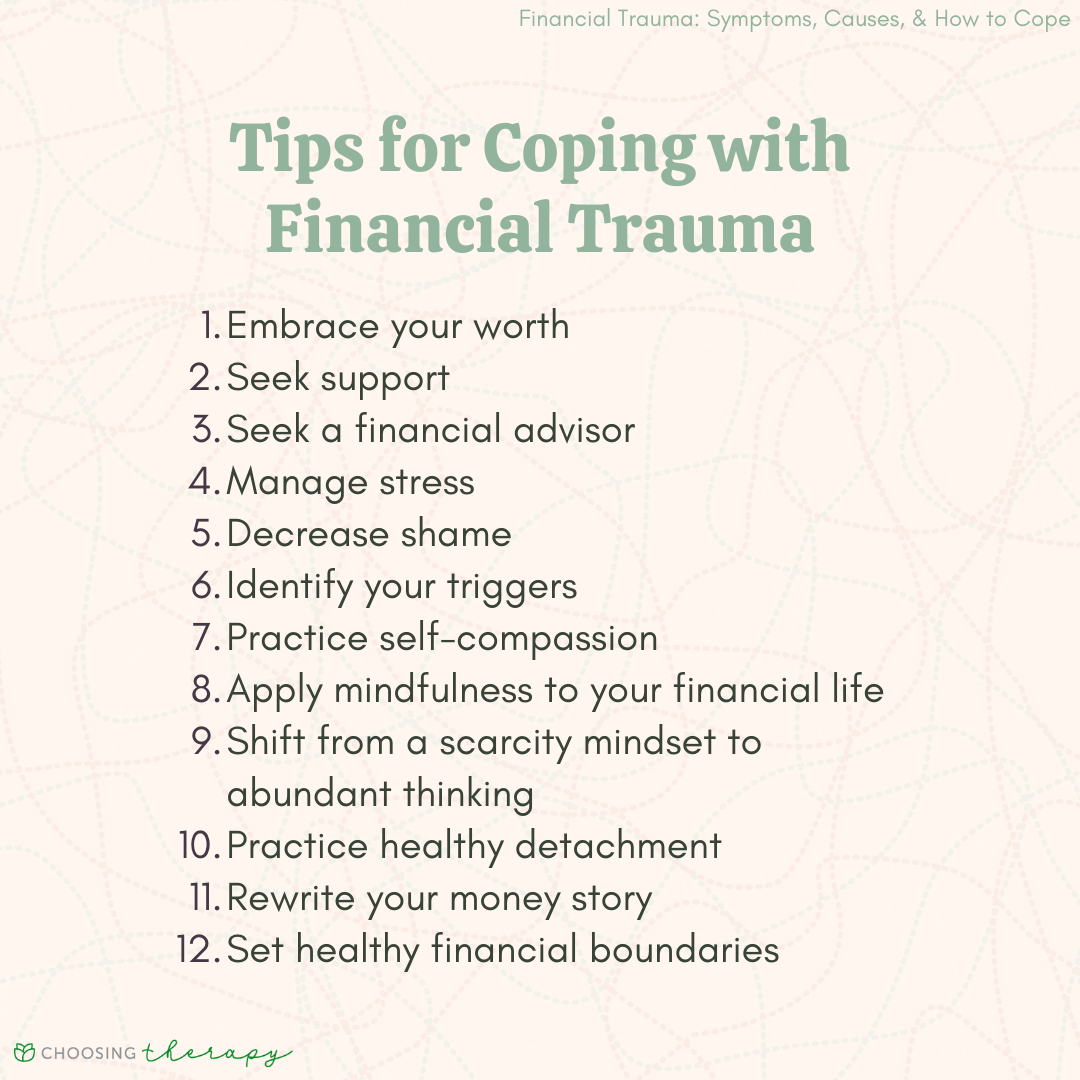

12 Tips for Coping With Financial Trauma

There are various strategies to cope with the effects of financial trauma and learn to overcome it. Doing so is often challenging, so be gentle with yourself as you figure out which methods work best for you.

Below are 12 tips for coping with financial trauma:

- Embrace your worth: Your financial struggles are HOW you are, not WHO you are. You are not your job title, bank account or debt. You are your own beautiful and unique spirit with unique gifts and talents to offer the world. Connect with your deepest and highest self through mindfulness practices such as meditation, deep breathing, and yoga to separate from ego (your mind’s understanding of who you are).

- Seek support: Talking about your financial challenges with friends, family, or professional therapists can lead to better problem-solving and more assistance, resources, and opportunities. It can also help you know you are not alone and boost your mental health and wellness.

- Seek a financial advisor: Seek out a financial advisor, financial planner, debt consolidation counselor, or other type of financial consultant. Even if you are financially literate, it can be invaluable to have the advice of an expert.

- Manage stress: Stress management is crucial, so make sure you are getting proper sleep, hydration, exercise and nutrition, as well as practicing good self-care.

- Decrease shame: Due to the shame and stigma associated with trauma and financial struggle, many people suffer in silence. Know that you are not alone and help is available.

- Identify your triggers: Knowing what people, places, or things might trigger your money trauma can help you anticipate the minefield and plan your coping strategies.

- Practice self-compassion: Honor your financial traumas and how they may have impacted you emotionally, spiritually, and financially. Stop self-blame and harsh self-judgment. View past challenges as opportunities for learning, growth, and increased resilience.

- Apply mindfulness to your financial life: Stop second-guessing the past or worrying about the future. Avoid “future tripping” or writing fiction about the unknown future. You can be responsive, rather than reactive, in financial actions.

- Shift from a scarcity mindset to abundant thinking: Shifting from a scarcity mindset to an abundance mindset opens doors to possibilities, collaborations, celebrating the successes of others, and greater prosperity.

- Practice healthy detachment: Practice healthy detachment strategies such as compartmentalization to set financial fears to the side so you can forge ahead with clarity and persistence.

- Rewrite your money story: Narrative therapy asserts that we are not only the protagonists of our own life stories, we are also the author. Appreciate the power of self-fulfilling prophecy and restructure catastrophic thinking to positive and affirming messages that you can and will succeed financially.

- Set healthy financial boundaries in your relationships: Use assertive communication to set financial limits with your friends, partner, kids, and anyone with whom you have a financial relationship.

When to Seek Professional Help

Therapy or counseling is a routine and preventative form of healthcare, like going to the dentist. You wouldn’t wait until you need a root canal to see the dentist, so schedule a mental wellness check-up to nip financial trauma symptoms in the bud. There are many benefits of therapy, including alleviating symptoms, increasing financial empowerment, and cultivating a plan for career and financial success, all while receiving support along the way. To find the right therapist, ask your doctor, friends, or family for a referral, or utilize an online therapist directory. It is most important that you feel comfortable with your therapist and that they are a fit for you and your unique needs.

Professional support options for financial trauma may include:

- Cognitive behavioral therapy (CBT):CBT asserts that our thoughts precede our emotions and behaviors. We need to restructure our beliefs to know we are each innately deserving of financial peace, financial freedom, and an abundant life.

- Eye movement desensitization and reprocessing (EMDR): EMDR for PTSD is trauma-based and can be effective, even in short term counseling. It may be very helpful in treating money trauma and financial PTSD.

- Family therapy:. Therapy with one or more family members can be extremely helpful if there are financial issues impacting your family system, or if financial trauma is impacting your familial relationships.

- Financial advising: Meet with a financial planner to assess your financial health and develop short and long-term goals. Financial advisors will promote your financial literacy and educate you on various options for debt management, budgeting, saving, and investing.

- Consumer Financial Protection Bureau: This government agency gives you access to tools and resources that can help improve your financial literacy and make informed, empowered financial decisions.

- Financial Counseling Association of America: This member-supported association can connect you to financial counseling, debt counseling, and various other financial services.

- Twelve Step support: There are free twelve step groups that address money issues such as Debtors Anonymous, Spenders Anonymous, Underearners Anonymous, Gamblers Anonymous, and more.

Final Thoughts

Financial trauma is very common especially during times of economic uncertainty, and can lead to serious emotional, social, physical, and financial impacts. Help is available and effective, so reach out for support. Continue learning by reading more on the topic and be sure to share this valuable information with others who may be struggling with financial PTSD.

Additional Resources

To help our readers take the next step in their mental health journey, Choosing Therapy has partnered with leaders in mental health and wellness. Choosing Therapy is compensated for marketing by the companies included below.

Talk Therapy

Online-Therapy.com – Get support and guidance from a licensed therapist. Online-Therapy.com provides 45 minutes weekly video sessions and unlimited text messaging with your therapist for only $64/week. Get Started

Virtual Psychiatry

Hims / Hers If you’re living with anxiety or depression, finding the right medication match may make all the difference. Connect with a licensed healthcare provider in just 12 – 48 hours. Explore FDA-approved treatment options and get free shipping, if prescribed. No insurance required. Get Started

Anxiety Newsletter

A free newsletter from Choosing Therapy for those impacted by anxiety. Get helpful tips and the latest information. Sign Up

Learn Mindfulness, Meditation, & Relaxation Techniques

Mindfulness.com – Change your life by practicing mindfulness. In a few minutes a day, you can start developing mindfulness and meditation skills. Free Trial

Choosing Therapy Directory

You can search for therapists by specialty, experience, insurance, or price, and location. Find a therapist today.

How Does ERP Help With Intrusive Thoughts? Obsessive compulsive disorder (OCD) is a psychiatric condition marked by the presence of obsessive thoughts, images, doubts, or urges, followed by compulsive behaviors or acts aimed at easing the distress caused by the obsession. While the content of the obsessions can take many forms, they are always repetitive, persistent, involuntary, and intrusive, and they often result in a great deal of anxiety for the person experiencing them. 9 Types of Therapy for Trauma Experiencing trauma can result in distressing and debilitating symptoms, but remind yourself that there is hope for healing. If you or a loved one is suffering from the aftereffects of trauma, consider seeking therapy. Trauma therapy can help you reclaim your life and a positive sense of self.